Project Overview

*To respect client confidentiality and non-disclosure, certain features, names, and details have been modified and/or omitted from this case study.*

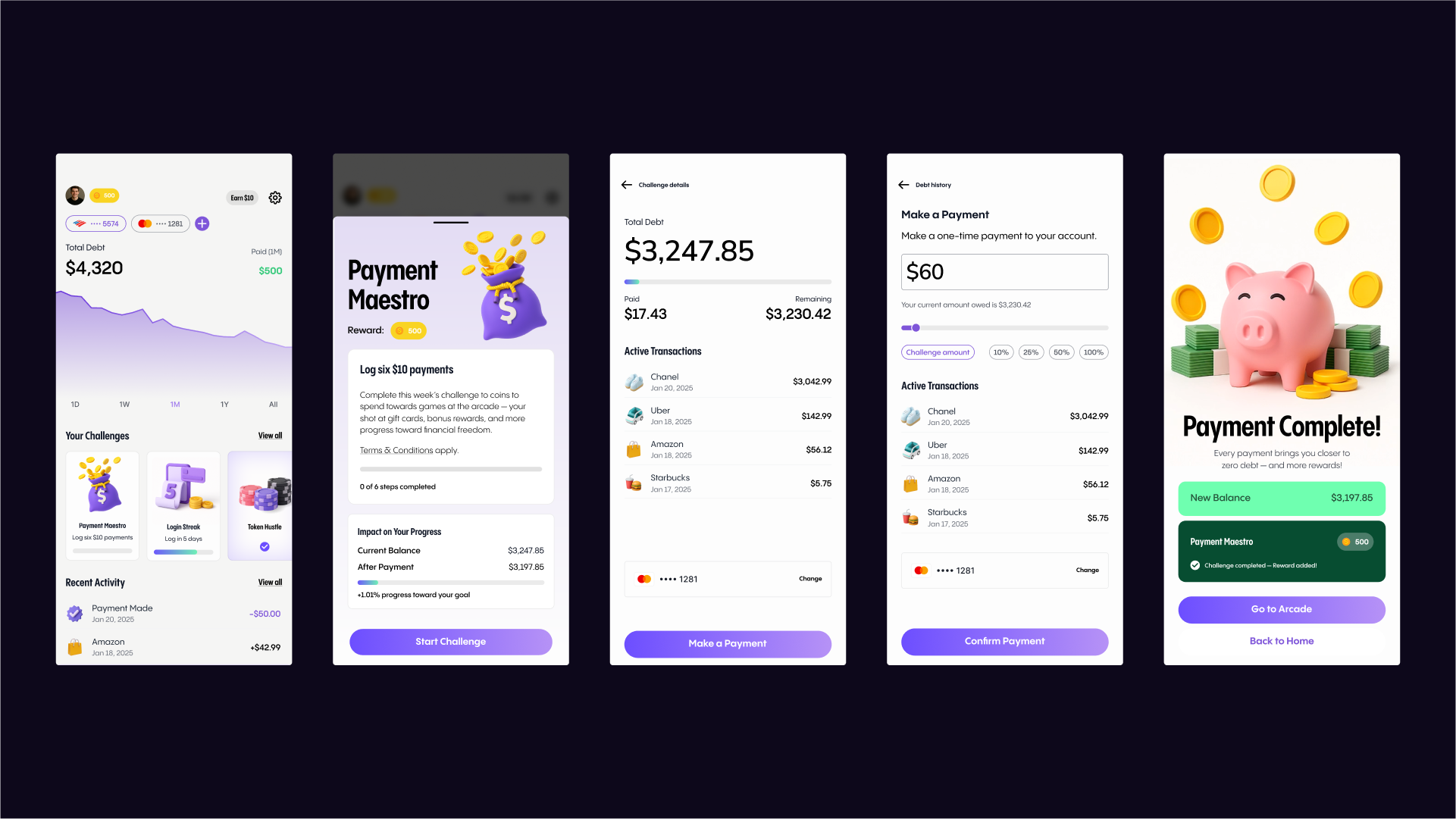

Paymaster is a fintech app designed for a new generation of users carrying the weight of credit card debt. The brief was to reimagine repayment not as a burden but as an engaging, rewarding habit. Working with a fintech startup client, we were tasked with designing the end-to-end user experience: conducting discovery research, defining the product strategy, mapping behavior loops, creating low-fidelity wireframes, designing a modular UI system, and delivering production-ready files to developers for a TestFlight beta release.

The result was an app that turned debt repayment into a motivational loop of small challenges, instant feedback, and tangible rewards.

The Challenge

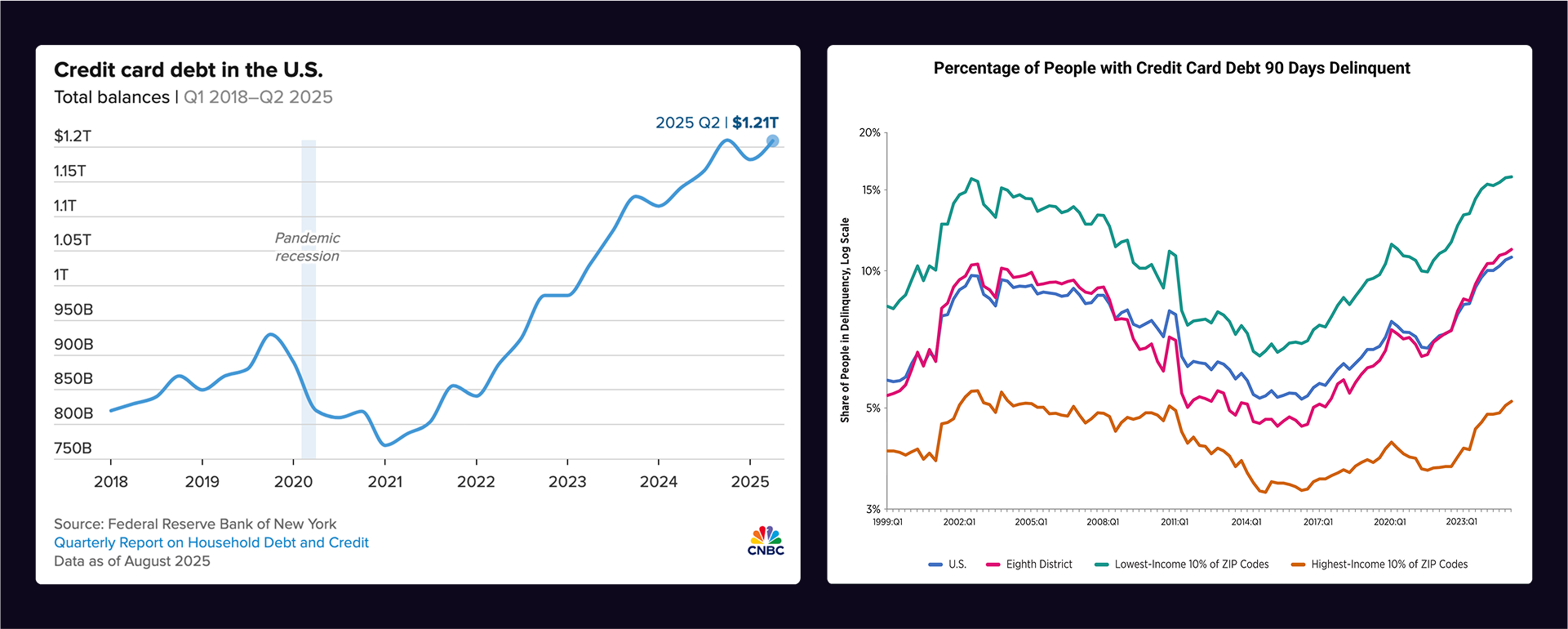

Credit card debt in the U.S. has surpassed $1.1 trillion, with younger users often carrying revolving balances month to month. Traditional budgeting tools often fail because they lean on shame, restriction, and complex data entry. This leaves users disengaged or worse, avoiding the app entirely.

Our client saw an opportunity to rethink the space: what if debt repayment could feel like winning? What if the small act of paying down a balance was tied to the same kind of instant gratification and emotional reward found in the apps people already love?

The design challenge for us as a team was to:

The Rising Cost of Debt

¹ Federal Reserve Bank of New York, Quarterly Report on Household Debt and Credit, August 2025

² Federal Reserve Bank of St. Louis, Credit Card Delinquency by ZIP Code Income Percentile, 2025

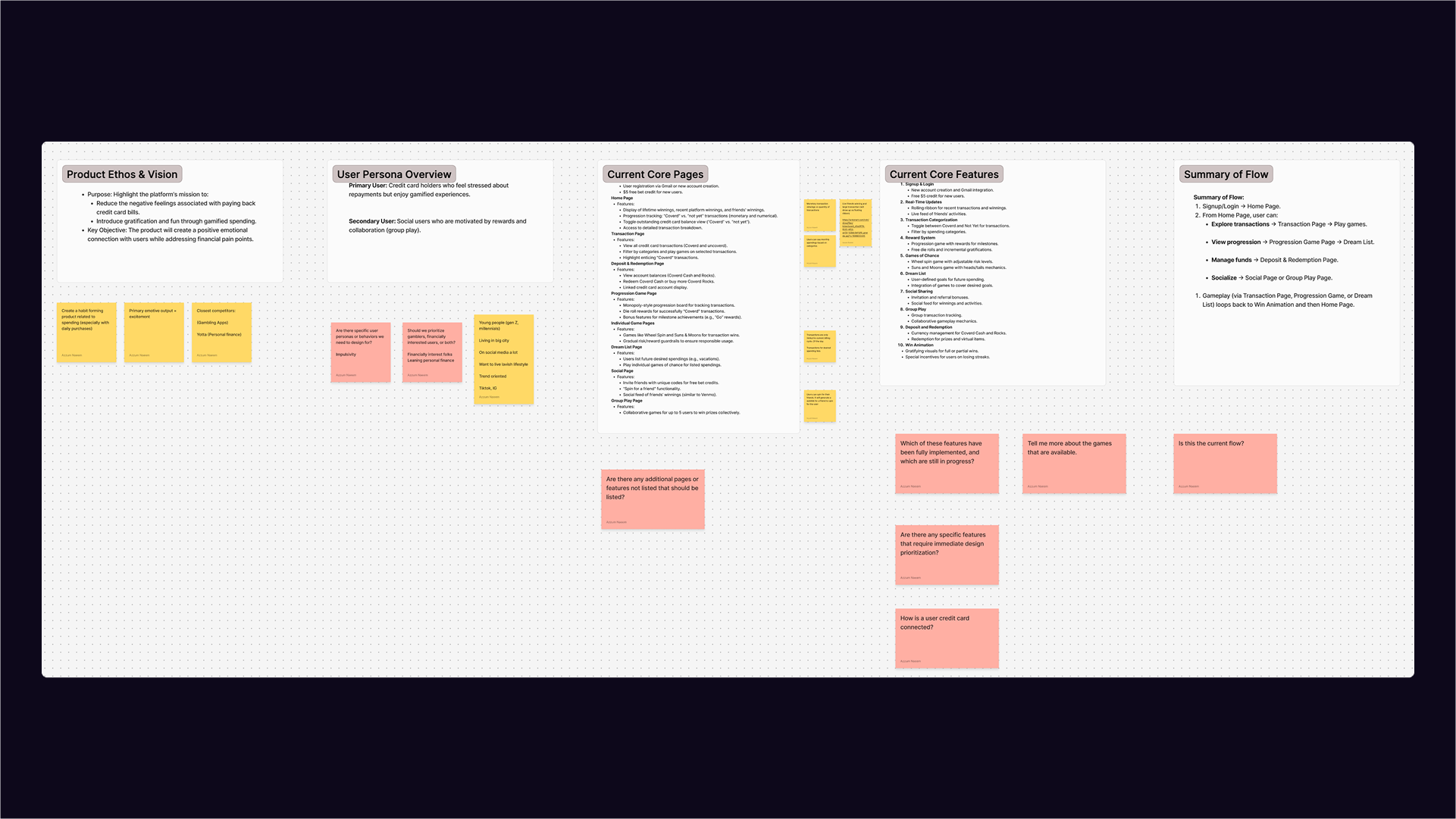

User Research and Persona

Through competitive analysis, lightweight interviews, and market research, we surfaced core pain points: existing tools felt complex, punitive, and uninspiring; users lacked emotional reinforcement to stay consistent with repayment; progress felt invisible, leading to low motivation and high drop-off.

From these insights, we defined our primary persona:

Jay, 26 — The “Trying, but Overwhelmed” Spender

Jay earns a steady salary but carries lingering debt. He wants to make progress but finds most budgeting apps condescending. Jay responds better to gamified challenges, streaks, and visible progress tracking — mechanics that align with his daily media habits on TikTok, casual games, and loyalty programs.

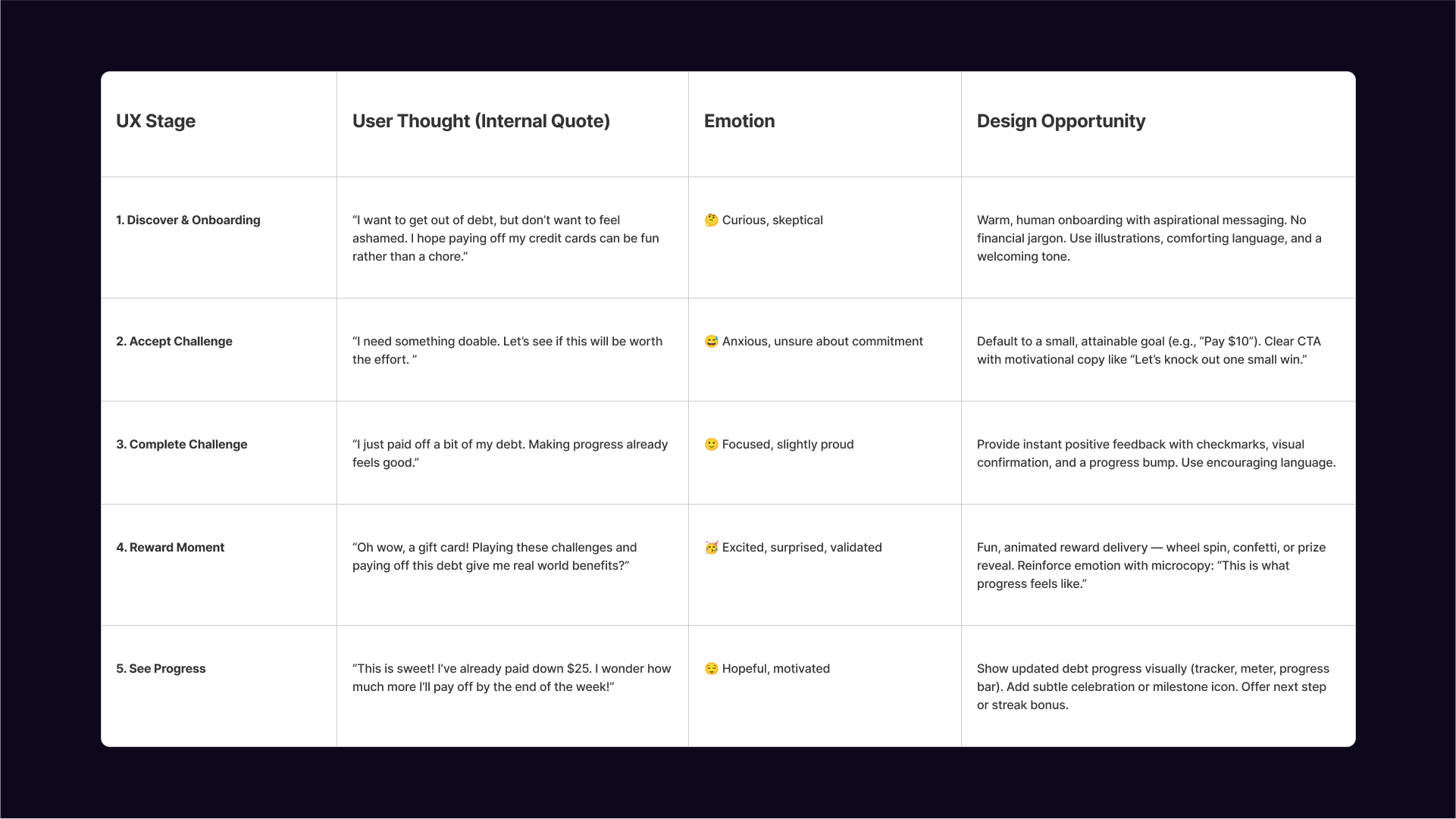

User Insights & Behavior Mapping

Mapping Jay’s journey highlighted the exact pain points that informed our strategy: simplify repayment flows, reward positive behavior, and sustain long-term engagement.

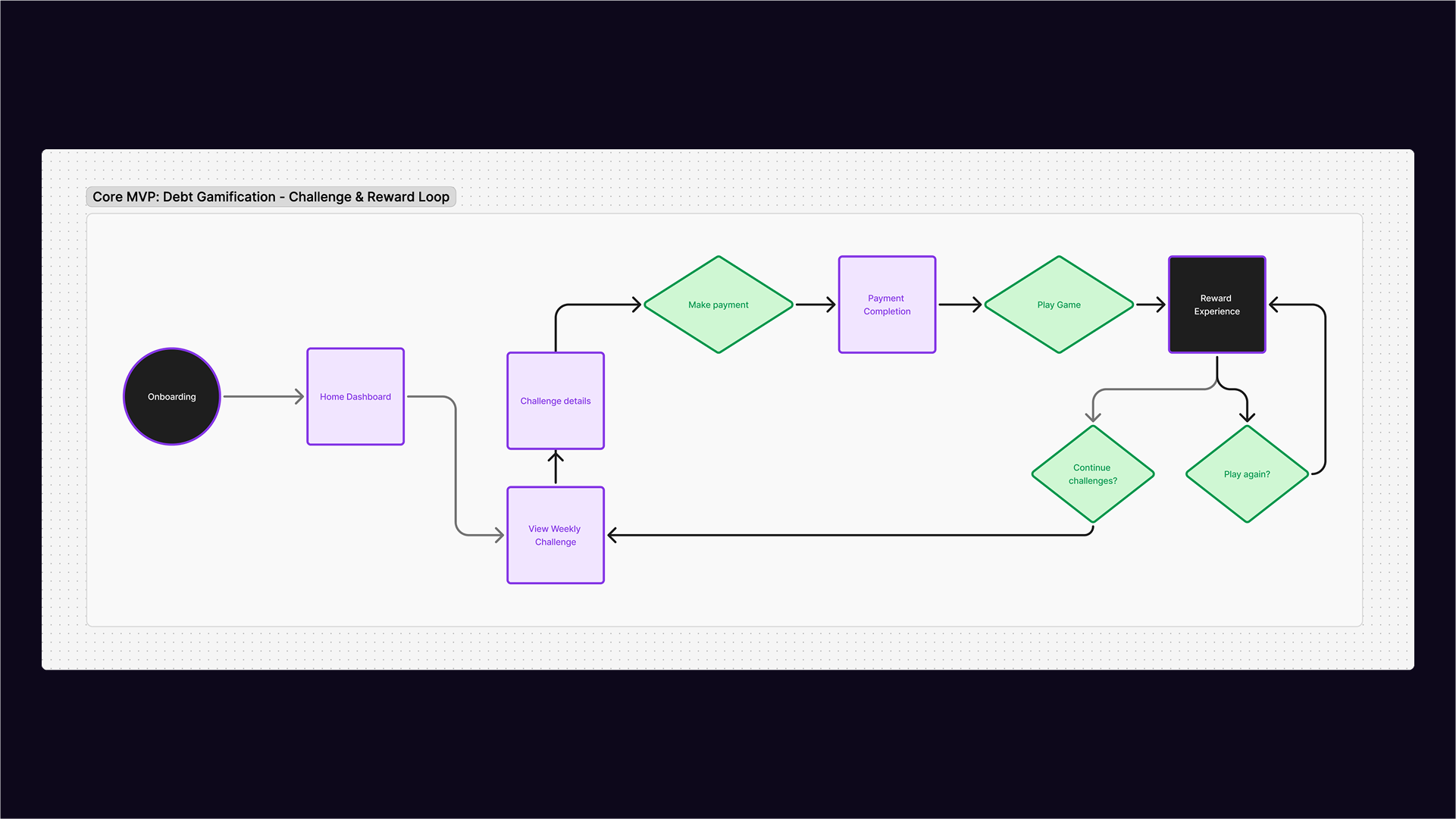

Defining the Core Loop

At the heart of Paymaster is a simple but powerful behavior loop:

Payoff Debt → Reward → Motivation to Return

1. Trigger: Surface a small, achievable repayment challenge (for example, “Pay $10 this week”).

2. Action: User confirms or logs the repayment with minimal friction.

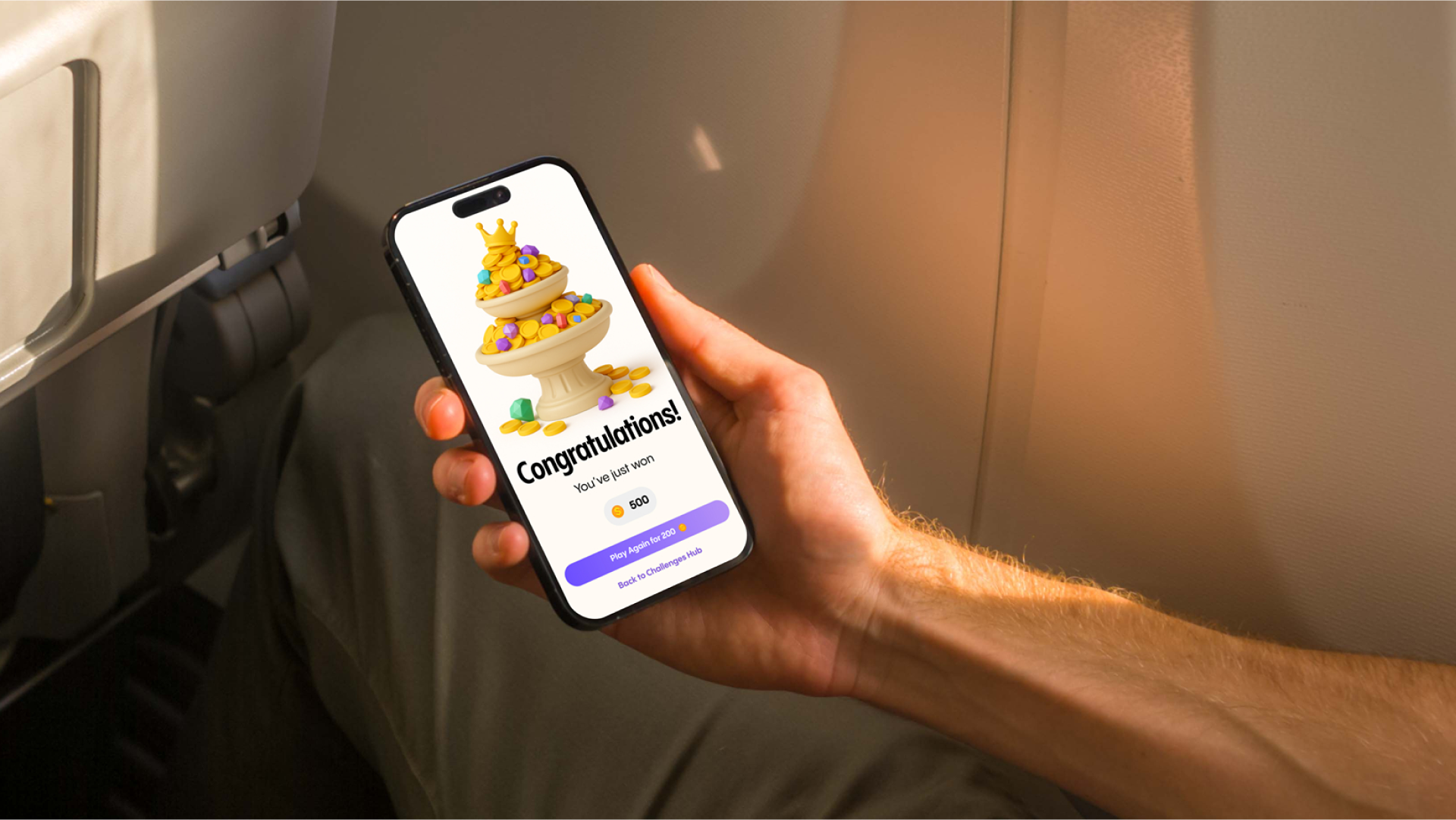

3. Reward: Deliver an emotional high point — a spin, slot, or arcade-style interaction tied to sponsored perks.

4. Progression: Update the debt tracker visualization, making progress visible.

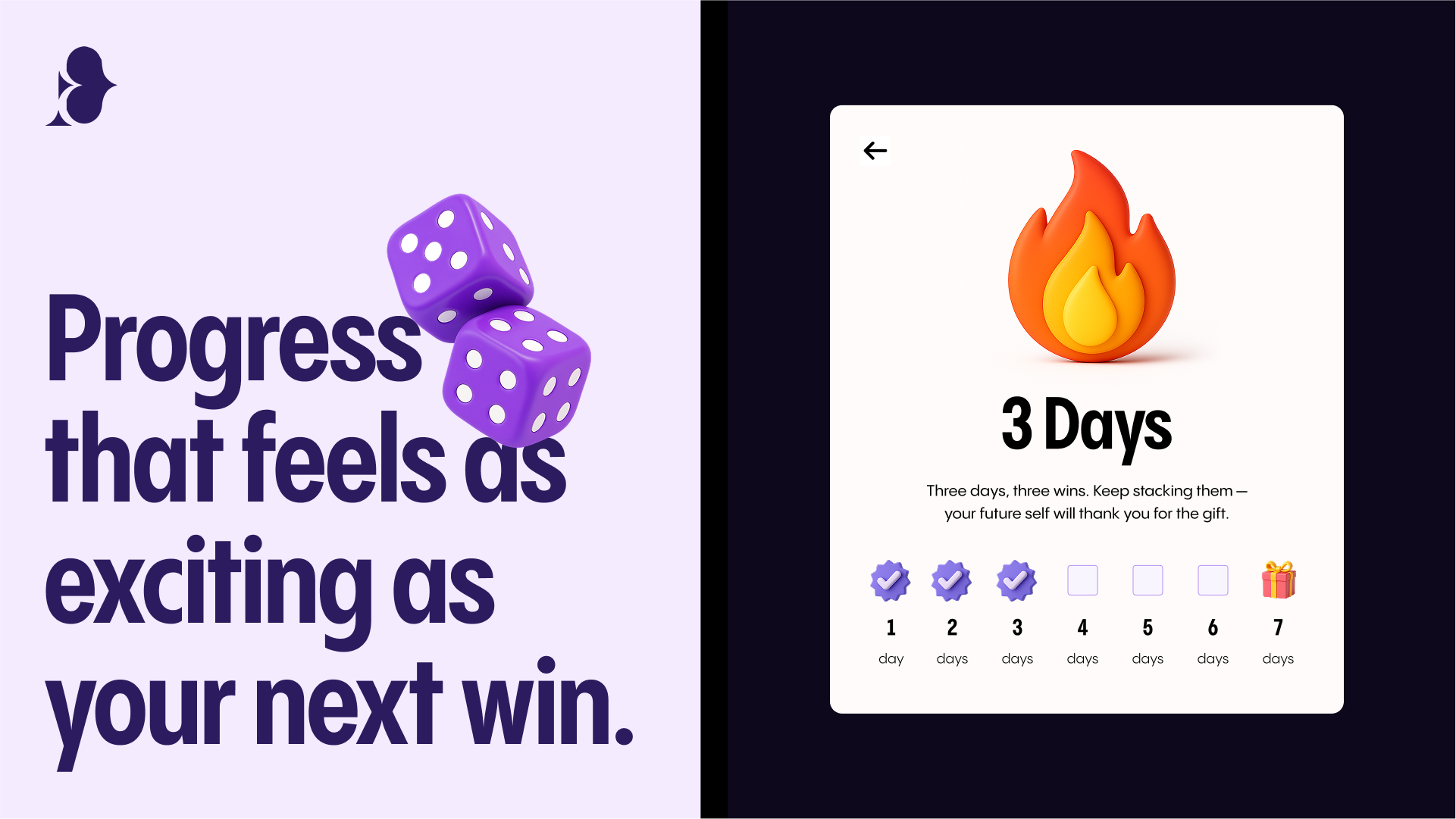

5. Repeat: Introduce new challenges, streak multipliers, and return incentives.

This loop became the north star of the MVP, guiding every UX flow, screen priority, and design decision. By keeping the MVP scope lean but behaviorally rich, we could validate whether gamified challenges and rewards truly influenced repayment behavior.

Building Off the MVP

For the client, to secure seed funding from investors we were asked to map the end-to-end user journey, expanding upon the MVP loop, then translated it into core flows & features.

Turning Debt Repayment Into Play

At the core of Paymaster’s experience was The Arcade, a branded reward layer where completing challenges and making payments unlocked the chance to win prizes. Instead of viewing repayment as a chore, users were invited into an environment of playful anticipation, where progress translated directly into opportunities for reward. This gamified system not only made the act of paying down debt more engaging but also reinforced consistent behavior through positive reinforcement and repeatable loops.

Leveraging AI in the Design Process

To speed up delivery, we integrated AI into both UX exploration and visual design. It served as a tool to rapidly prototype and broaden creative exploration, while final decisions were guided by design judgment to ensure every asset remained consistent with the product’s brand story.

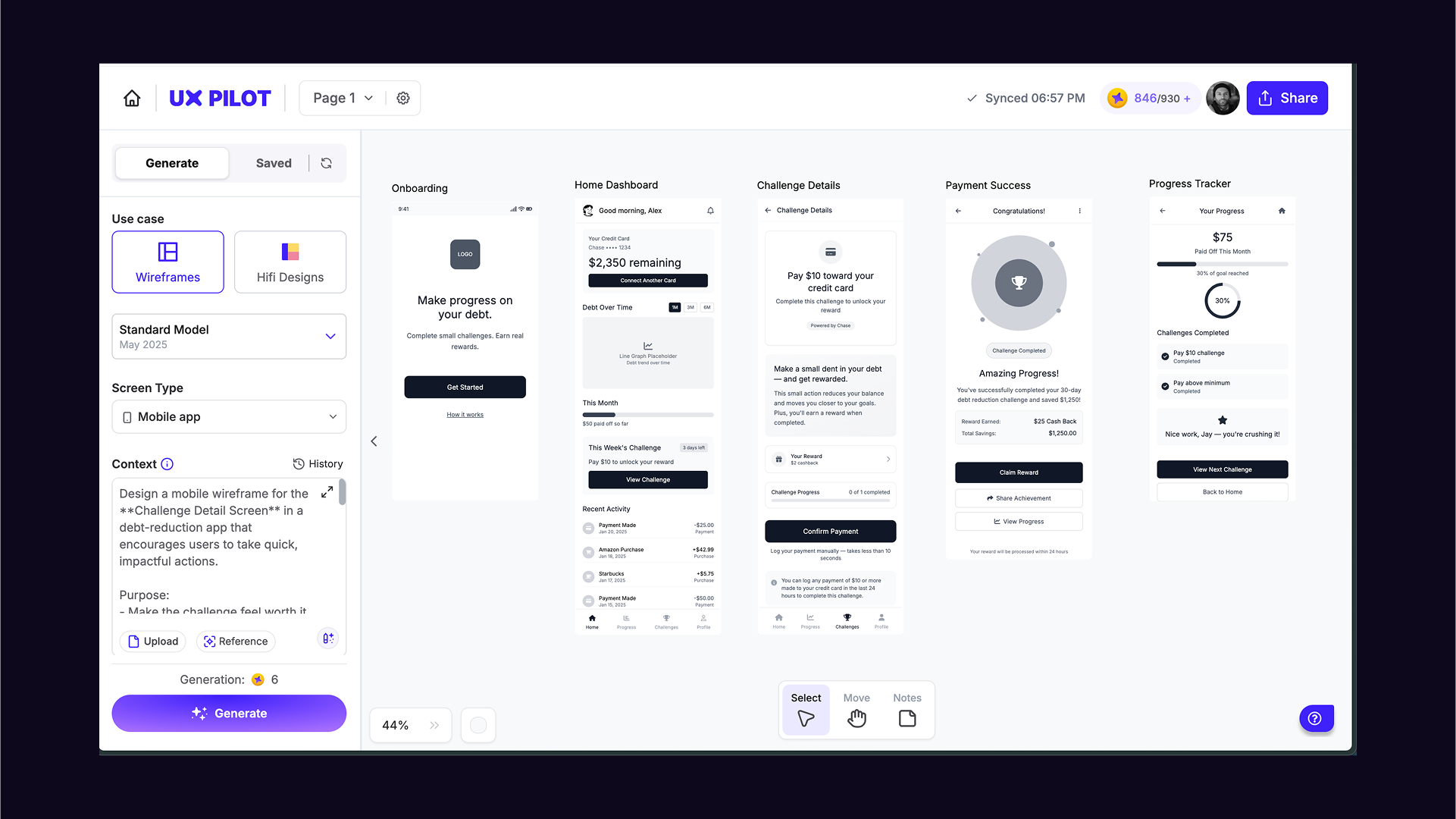

AI-Assisted Wireframing to Accelerate Alignment

Using UX Pilot, an AI software, we generated rapid low-fidelity wireframes to validate flows and content strategy. This allowed stakeholders to visualize key interactions early, align on priorities, and move faster toward high-fidelity design without losing time in manual iterations.

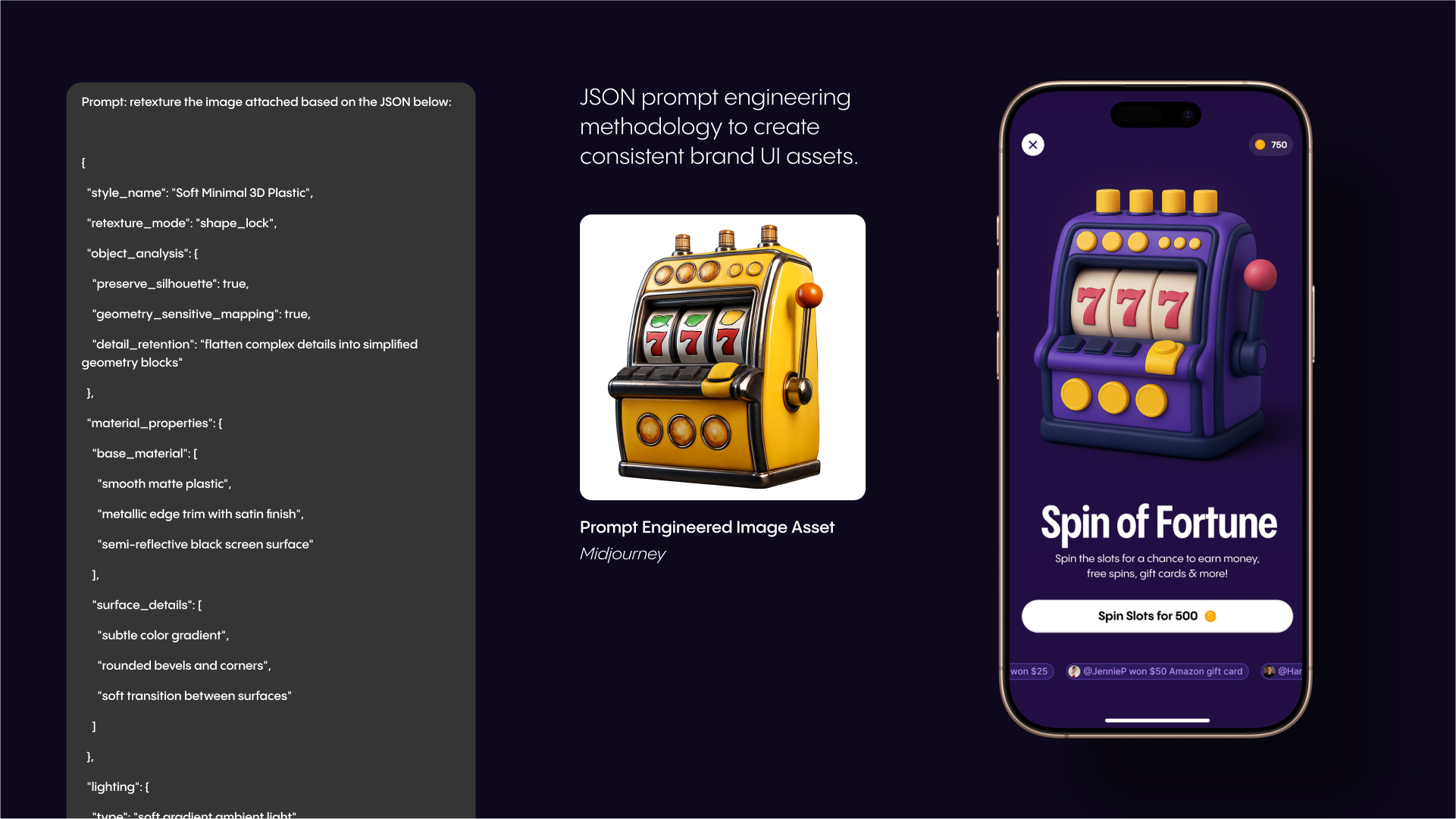

Visual Consistency Through Ai Prompt Engineering

We used JSON-based prompt engineering with MidJourney and DALL·E to generate branded 3D assets. By encoding material properties, lighting, and gradients into structured prompts, we ensured every visual element, from slot machines to tokens, was stylistically consistent and aligned with the app’s playful brand identity. This method allowed us to scale asset creation quickly without sacrificing cohesion or polish.

Outcome and Impact

The final delivery included a full design system, developer-ready screens, and asset library, all handed off to engineering for TestFlight beta testing.

Key outcomes from the beta:

For our client, this validated a scalable product model that not only improves user financial health but also strengthens retention and investor appeal.

Following the beta release, the client successfully secured seed investment from early-stage investors, using the product’s engagement results as validation.